vrsofttech.contact@gmail.com

vrsofttech.contact@gmail.com

Opening Hours : Monday to Saturay - 10 AM to 8 PM

For Enquiry? Call us on

+91 87787 31770For Enquiry? Call us on

+91 87787 31770Python Projects

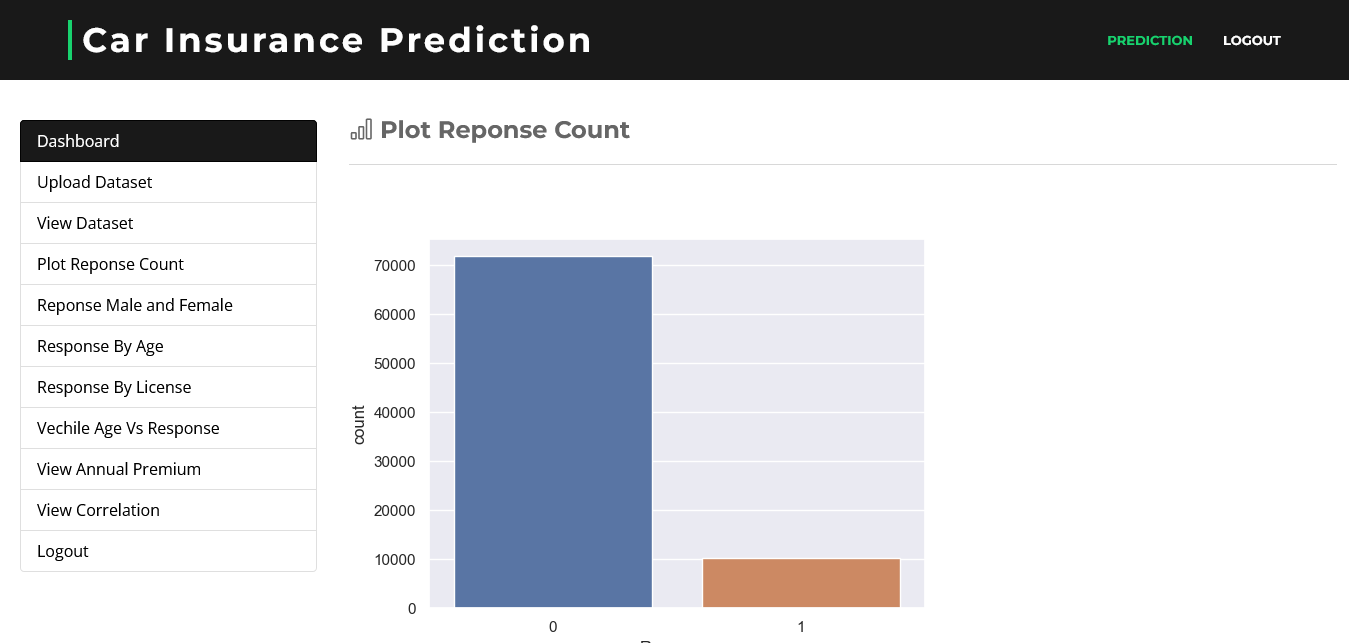

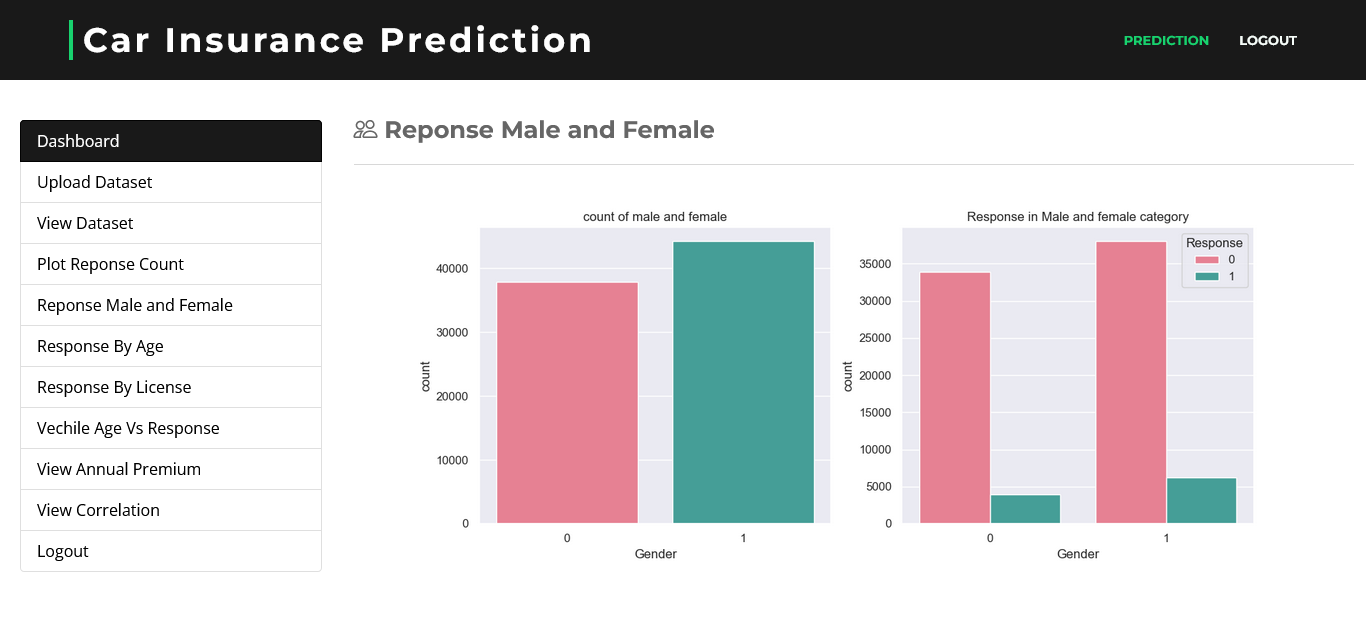

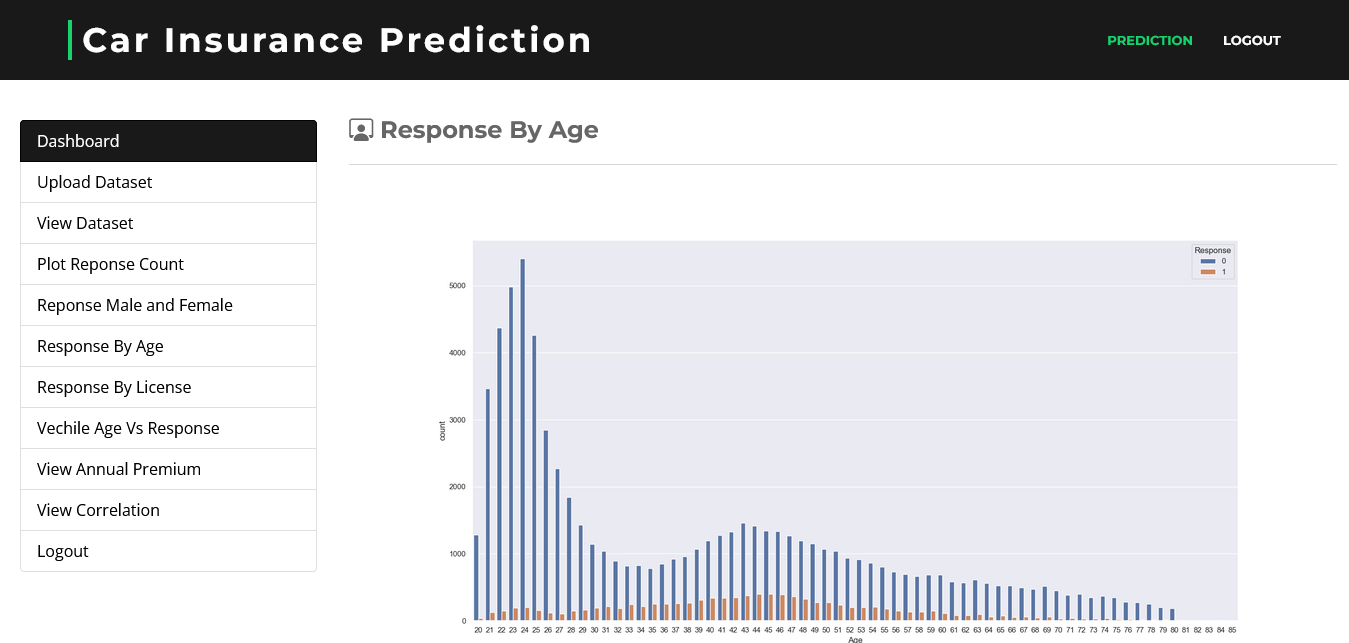

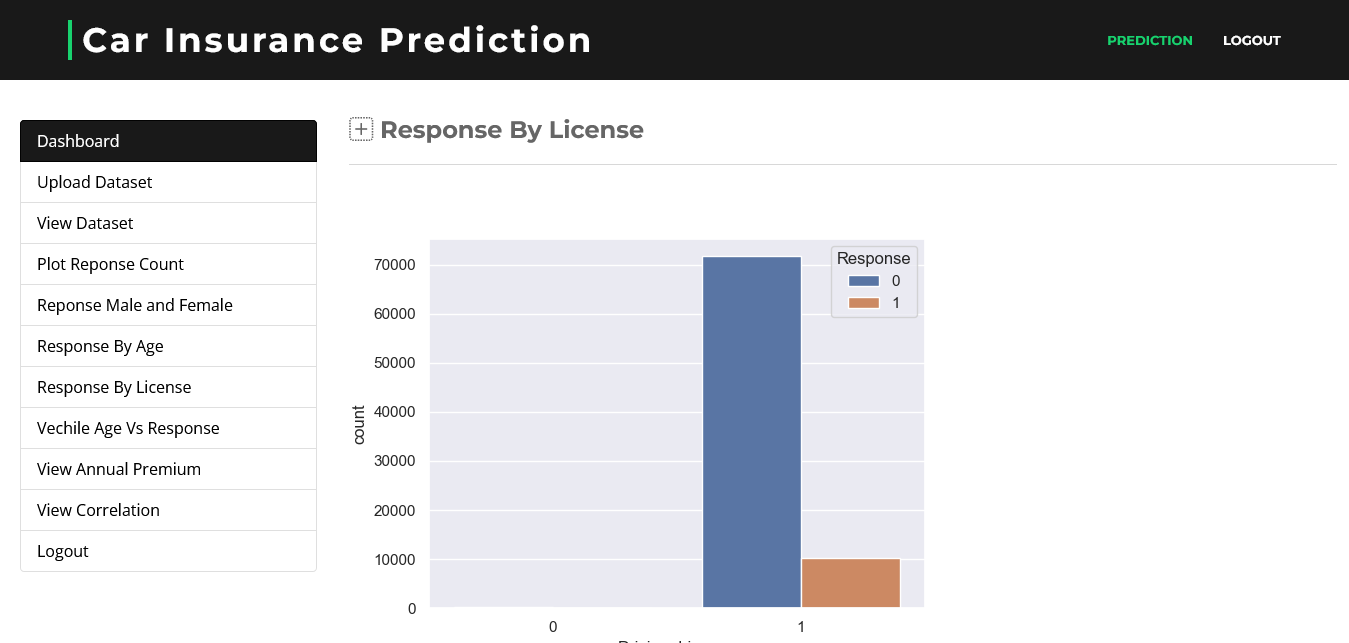

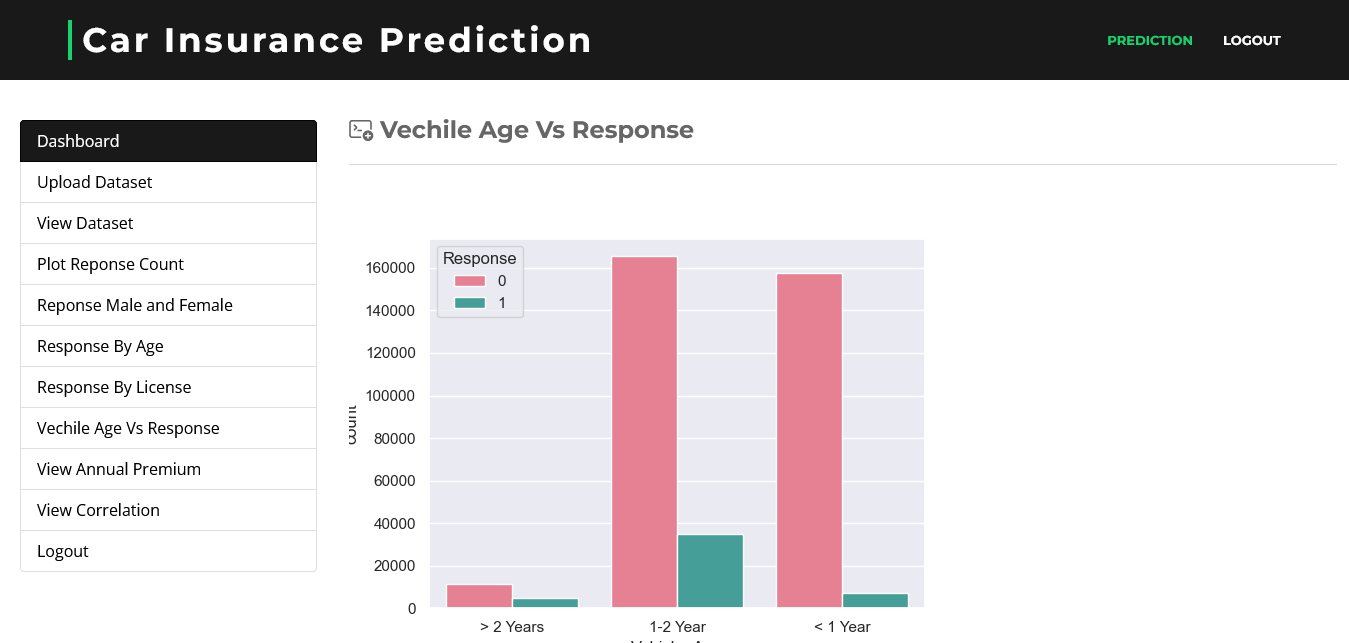

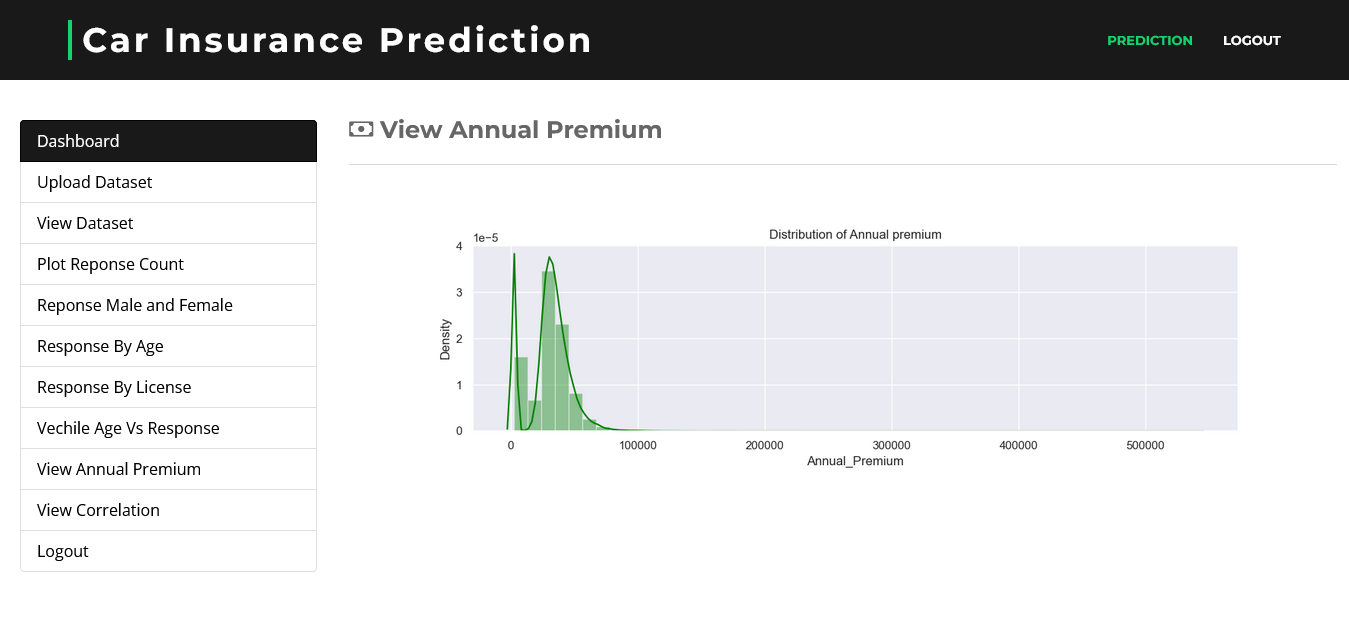

A Study on a Car Insurance Purchase Prediction Using Machine Learning

Now a day's Data is playing a central role and is carrying the big asset in the insurance industry. The insurance companies are tremendously interested in the prediction of the future. Accurate prediction gives a probability to decrease financial loss for the company. The insurers use rather complex methodologies for this purpose. The major models are a decision tree, a random forest, a binary logistic regression, and a support vector machine. A great number of different variables are under analysis in this case. The most important advantage of Machine Learning (ML) to use in Insurance Industry is to facilitate data sets. Machine learning (ML) can be successfully useful across Structured, Semi Structured or Unstructured datasets. Machine learning can be used accurate across the value chain to identify with risk, claims and customer actions, by means of advanced predictive accurateness. The probable applications of machine learning in insurance are plentiful from perceptive risk appetite and premium leakage, to expense administration, subrogation, proceedings and fraud detection. Machine learning is not a novel technology; this technology is following from the last few decades. There are 3 main categories of learning they are supervised learning, Unsupervised Learning and reinforcement learning. The greater part of the insurers are following Supervised Learning from last few decades for assessing the risk by means of known parameters in dissimilar combinations to acquire the preferred outcome. Present age insurers are motivated to unsupervised learning, in this predestined goals are clear. If there are any modifications in the variables, the method identifies those modifications and tries to change as per the goals.

Project Sample Pages :

Related Projects

- Advancements in Reversible Data Hiding In Encrypted Images Using Public Key Cryptography

- Secureserve Automated User-Centric Platform for Volunteer Recruitment and Retention for Non-Profits

- Identifying Suspicious Patterns in Financial Transactions with Machine Learning

- Research and Application of Data Privacy Protection Technology Using Third Party Auditor In Cloud Computing

- A Copyright Preserving and Fair Image Trading Scheme Based on Block chain Technology

- Leveraging Artificial Intelligence for Personalized Marketing Campaigns to Improve Conversion Rates

- Enabling Cyber Security Data Sharing For Large-Scale Enterprises Using Managed Security Services

- Predicting Stock Market Trends Using Machine Learning and Deep Learning Algorithms via Continuous Binary Data

- Web-Based Pharmacy Management System

- A Smart School Management System for Enhancing Administrative Efficiency and Academic Tracking